The Mortgage Voice

Here on The Mortgage Voice, we believe that getting a mortgage should be the way to enter into the wealth-building that all Americans are entitled to. Yes, you should be able to get a loan to afford the house you want. We interview three guests a week who come from all over the industry and all over the country. Information is the way to be able to make the best decision. This is not a commercial, it is the needed information for you to make the best decision. Loan Officers, bankers, agents, account executives, title/escrow officers are just some of the job descriptions of the guests we have on the show. For seven years, providing this service has been part of what we do for the public.

Features Overview

Marry the House, But Only Date the Interest Rate

May 7, 2024

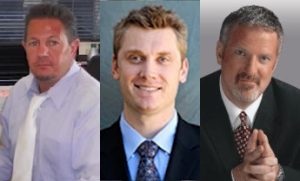

Jeff advises potential homebuyers in this uncertain financial climate to find a property that is right for them instead of focusing on the high rates. With the shortage of available houses on the market, the window to snap up a property is short and likely has many other applicants. Is the answer to buy now and refinance later when rates drop? Guests Ciro De Palma, Luke Manke, and Bill Orr reveal updates on new loan types, the advantage of cash over financed offers, and the state of home insurance.

Learn More →

Hey Fed, Why Such High Rates?

April 30, 2024

Jeff tries to make some sense of the continued high interest rates facing the mortgage industry by breaking down some of the contributing factors. Although unemployment has remained under four percent over the past two years, suggesting a robust economy, the Fed shows no indication that it plans to lower rates anytime soon. What implications will this have for those already struggling with high home prices? Guests Michelle Wilde-Powell and Charles Giscombe provide ideas for thinking outside the box when it comes to mortgages.

Learn More →

What Exactly is Stagflation?

April 25, 2024

Jeff defines the most recent buzzword that many are concerned will be the next step for the economy – stagflation. This is characterized by an economic situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. Is the US headed in that direction and can the Fed do something about it? Guests Mikke Pierson and George Gonzales shed some light on business growth strategies and second mortgages as a solution to consolidate debt.

Learn More →

The Importance of the Human Factor in Real Estate

April 18, 2024

Jeff examines the potential impact of AI on the mortgage industry, where the latest sector to be affected is the appraisal process. Appraisals are under scrutiny as many push for the efficiency that AI could potentially offer. How much would electronic models miss out on that experienced human professionals bring to the table? What are the employment implications if AI makes some jobs obsolete? Guests Shaun Dennison and Wendy Van Wessel share non-QM products and home equity strategies

Learn More →

Positive Trends in the Marketplace

April 9, 2024

Jeff notes that there are some bright spots in the market despite the current challenges of high interest rates and low inventory. Unseasonably cold weather in SoCal has not kept prospective buyers from scoping out available homes, regions of the USA are enjoying a 15% decrease in housing prices, and the overall economy is looking strong. Will the Fed take these as a sign to lower rates? Guests Tony Masci and Charles Giscombe have some innovative loan solutions for entrepreneurs and those with non-traditional incomes.

Learn More →

The Ever-Evolving Real Estate Landscape

March 27, 2024

Jeff navigates the complex terrain of today's real estate landscape, where, even though rates have stabilized, they are still much higher than in recent years. With the potential for property values to appreciate, could now be a good time to buy? How will the recent settlement between the National Association of Realtors and the Justice Department alter the way real estate commissions are structured and how will it impact both sides of a transaction? Guests Jennifer Martinez and Connie Hernandez offer some perspectives on changes ahead in the market.

Learn More →

Extreme Weather Conditions Complicate Homebuying

March 6, 2024

Jeff outlines the difficulties that extreme weather and natural disasters cause in the real estate market in the wake of the heavy rains in California. Such events have an impact on property values and lending decisions alike, so how can homeowners and potential buyers prepare for the challenges they may face? How will the lowering of the national average credit score affect rates? Guests Wendy Van Wessel, Tomas Trujillo, and Jennifer Conrad encourage researching alternative loan options and stress the importance of staying informed.

Learn More →

The Baby Boom Tsunami

March 1, 2024

Jeff sheds some light on the impact of the phenomenon known as "the baby boom tsunami," a term given to the group of baby boomers projected to be selling their homes over the next decade. How many homes could this add to the market? How is the current lack of sufficient properties affecting housing prices and affordability for first-time homebuyers? Guests Chris Piro and Tiffany Nguyen advise on the various lending products open to borrowers in all types of financial situations.

Learn More →

Why Won’t the Fed Lower Interest Rates?

February 23, 2024

Jeff explores the various economic indicators that determine how the Fed structures interest rates. With mortgage rates over 7% and higher inventory causing home prices to wane, economic factors like stubbornly high 3% inflation make Fed rate cuts unlikely soon. Could the stock market’s performance offer cautious optimism about the health of the economy? How can homebuyers navigate the high-rate environment until rates become more manageable? Guests Jamal Bransford and Charles Giscombe share some alternative options to make that happen.

Learn More →

Is Mortgage Rate Stability on the Horizon?

February 15, 2024

Jeff considers the potential for future mortgage interest rate stabilization or even decreases ahead as a possible bright spot in market volatility. With inflation impacting so many areas of the economy, many obstacles are still in the way of creating the housing needed amid a continued inventory shortage. Are corporate greed and supply chain issues largely to blame? Guests Nina Penny and April Lopez provide insights into reverse mortgages and popular loan products and programs.

Learn More →

Navigating the Market Amid Fluctuations in Mortgage Rates

February 9, 2024

Jeff delves into the dynamics of mortgage-backed securities and the relationship between the 10-year Treasury yield and mortgage rates. Rates are influenced by the yield on mortgage-backed securities, which needs to be competitive with the 10-year Treasury, but the two often vary significantly. What factors contribute to these fluctuations, and how can borrowers navigate a rising rate environment? Guests Maureen Reynosa, Seth Soloway, and Charles Giscombe explore non-traditional loan options and emphasize the importance of transparency in the loan process.

Learn More →

How Will Looming National Debt Interest Payments Impact Mortgages?

February 2, 2024

Jeff analyzes several key economic factors affecting the mortgage industry, including inflation, the national debt, and the reliability of government data. Will the upcoming interest rate payments on the national debt mean cuts to much-needed programs and services? How do homebuyers make solid long-term decisions with constantly fluctuating information? Guests Gentille Chhun, Cari Anderson, and Charles Giscombe offer effective strategies to help cut through the confusion.

Learn More →

Consumer Sentiment Indices and the State of the American Psyche

February 21, 2023

Jeff considers how the instability of many factors in the current economic climate – the war in Ukraine, housing inventory, mortgage rates, and inflation – impact the American psyche. Monthly surveys like the Michigan Consumer Sentiment Index report how consumers feel about conditions in the economy and what actions they’re likely to take. Is the American psyche in good shape at the moment? Guests Audrea Johnson, Dr. Jeannie Bertoli, and Julie Reis share ways to help boost consumer confidence.

Learn More →

Trying to Make Sense Out of Inflation Information

February 14, 2023

Jeff wonders why it’s so difficult to get a more definitive handle on the direction of inflation. Economists give conflicting forecasts based on information released by the Fed, with predictions ranging from the stickiness of inflation to possible sudden drops in rates. How can buyers plan in such an unstable environment? Guests Charles Giscombe, Jamal Ransford, and Julie Peisner shed some light on options to give consumers the confidence to embark on their homebuying journey.

Learn More →

Is a Good Mortgage Rate Out of Reach for Most Home Buyers?

February 8, 2023

With rates on the rise again from the almost unheard-of lows seen during the last couple of years, many people wonder if they can buy a home at an affordable rate. Perhaps credit scores aren’t what they should be, a family member fell ill, or there was a gap in employment during the pandemic, resulting in a change in income. Are these and other issues roadblocks to homeownership? Guests Luke Manke, Tim Wise, and Bill Orr offer insights into finding help in this uncertain market.

Learn More →

Factors That Affect the Decision to Buy a Home

February 1, 2023

Jeff explores many of the questions that worry homebuyers, some of which are always on the checklist and others that have stemmed from difficulties exacerbated by the pandemic. Can we afford a home? What are the rates? Will the Fed keep raising rates, and how will that affect the prices of everything else in our lives? What if there has been a job loss or medical emergency? Guests Charles Giscombe, Kim Tran, and Tomas Trujillo share some tools to make homebuying easier.

Learn More →

The Outlook for 2023

January 27, 2023

Jeff makes some predictions for 2023 regarding the real estate industry, home values, and interest rates. How do experts view the economic health of the year ahead? Will the Fed Fund rate increase? What changes are on the horizon for mortgage rates? Is the specter of a recession looming? Guests Charles Giscombe, George Gonzales, and Joan Rebaza discuss the latest developments in products and communication in the industry to assist consumers in preparing to buy a home.

Learn More →

National is Not Local in the Real Estate Market

July 20, 2022

Jeff outlines some recommendations for homebuyers in the current real estate market, emphasizing that what is happening nationally does not always reflect the conditions present in individual areas of the country. Buyers need to focus on what is required to buy a home in the specific community they’re interested in and to prepare according to that criteria. Guests Henry Park, Eric Morgenson, and Gentille Chhun comment on changes in the industry and how individual markets are responding.

Learn More →

The Changing Market

July 6, 2022

Jeff discusses how the various sectors of the real estate market are changing, whether in the individual areas of the country or in the industry itself and how they all comprise a mixed market. Why are conditions not the same across the board, what lies ahead with rates and prices, and is there any relief in sight? Guests Stacy Hartmann, George Gonzales, and Gayle Whiting provide some insight into navigating through the often confusing nature of this current climate.

Learn More →

The Sea Change in the Mortgage Industry

June 29, 2022

Jeff delves into the many forms of inflation and how the perception of what causes it heralds changes throughout the economy and the mortgage industry. With so many life-altering events occurring over the last several years that have influenced inflation, will this be a motivating factor for buyers who didn’t act when the rates were low? Guests Josh Thompson, Mike Chapman, and Charles Giscombe share how their clients are dealing with these changes on the path to homeownership.

Learn More →

Is a Recession Imminent?

June 22, 2022

Jeff examines the clues that may lead to a potential recession in the US. The word itself evokes visions of unemployment, a big drop in the stock market, and a weakening of the real estate market. Is it a done deal, or will experts be able to steer the economy away from a major decline in the nick of time? Guests Cindy Bui, Livier Becerra, and Chris Groves advise on how to stay confident in the home-buying process during this turbulent period.

Learn More →

Inflation and the Pursuit of Higher Profit Margins

June 15, 2022

Jeff explains the relationship between higher costs and profitability to shareholders when it comes to the impact of inflation. The availability of cheaper foreign products has been reduced because of supply chain issues, and with domestic manufacturing not as robust due to the demand for higher wages and profits, consumers must pay more for everything. What does this mean for the housing market? Guests Sonya Hadley, Mark Hays, and Richard Greene share how their regions are affected.

Learn More →

The Housing Market and the Affordability Index

June 8, 2022

Jeff sheds some light on the affordability index and the overall effect interest rates and inflation have, not only on a buyer’s potential to qualify for a mortgage, but also on the availability of properties in the housing market. Given the rapid rise in interest rates, is there a light at the end of the tunnel for prospective home buyers? Guests Kim Soash, Charles Giscombe, and Joann Munz weigh in on non-QM loans, shadow inventory, and the Las Vegas market.

Learn More →

Keeping Nerves Steady in an Uncertain Market

June 1, 2022

Jeff considers the myriad causes of stress that seep into every aspect of our lives, with those stressors seeming to compound when the anxiety over buying a home is thrown into the mix. Is the dream of home ownership slipping further away for many in the current market? Guests Tyrell Robinson and Nina Penny have some ideas to help save that dream and turn it into reality.

Learn More →

What is the Flight to Safety?

May 25, 2022

Jeff explains the phenomenon, known as “the flight to safety,” that occurs when there is instability or uncertainty in the world - major shifts in the stock market, war, or a natural disaster, for example - causing investors to pull their money out of the stock market and put it somewhere more protected, which can make interest rates go through the roof. What does this mean for home buyers? Guests Kim Tran, Jennifer Conrad, and Wendy Van Wessel discuss available options.

Learn More →

Dealing with Discrimination in Real Estate

May 12, 2022

Jeff contemplates the disparity between the advantaged and disadvantaged in the rapidly evolving real estate market. The better opportunities for the upper echelon of the mortgage industry compared to smaller companies are reflected in the imbalance between those with more money and better credit and groups with fewer resources that are less financially secure. How can the discrimination gap be bridged? Guests Katherine Martin, Justin Hardman, and Thomas Trujillo offer some solutions.

Learn More →

Why is it So Tough to Get a Mortgage These Days?

May 4, 2022

Jeff ponders the many issues being faced in the real estate market, from skyrocketing rates and loan costs to the specter of lending bias, to the possibility of fraud with loans increasingly more difficult to get. What are the pitfalls and caveats to consider when trying to secure a home loan? Guests Josh Thompson, Bill Orr, and George Gonzales provide some insight on how to navigate through obstacles in the current mortgage environment.

Learn More →

Exploring Program Options in a Tight Market

April 29, 2022

Jeff details the marked trajectory mortgage rates have taken since the beginning of the year. The number of properties on the market has declined, and multiple parties are bidding for those that are obtainable, driving prices out of reach for most people. What assistance is available to help more people become homeowners? Guests Eddie Rael, Charles Giscombe, and Brenda Scott offer some options towards attaining that goal.

Learn More →

The Benefits of a Mortgage Rate Lock

April 20, 2022

Jeff breaks down the importance of locking in a loan rate. With rates rising at a pace not experienced in 40 years, securing a lock-in is more critical than ever. What essentials will help lenders guarantee an affordable rate before rates get even more astronomical? Guests Lena Waltham, April Lopez, and Arzo Yusuf shed some light on this subject, as well as on the humanitarian issues of human trafficking and relief for Afghan refugees.

Learn More →

Achieving Focus in a World Full of Distractions

April 15, 2022

Jeff delves into the myriad distractions that keep us in an almost constant state of worry, whether it’s family issues, inflation, war, or local and world news. Layer this on top of considering buying a home in the current climate, and it’s almost too much to take in. How can you stay focused? Guests Charles Giscombe, Connie Hernandez, and Mike Torres target some options to help streamline the process.

Learn More →

Skyrocketing Interest Rates and US Debt

March 23, 2022

Jeff sheds some light on how interest rates have climbed to an astronomical height in the first three months of this year, with a rapidity not seen since 1994 for a similar time period. Will rates continue to escalate, and is there a reprieve in sight for the average homebuyer? Guests Jennifer Conrad, Stacy Hartmann, and Jennifer Long discuss rates and share some products designed to bring more buyers to the marketplace.

Learn More →

Round-the-Clock News Adds to the Stress of Homebuying

March 16, 2022

Jeff examines how the 24/7 news cycles continually remind us of how inflation, Covid, and the war in Ukraine are making everything more expensive and add to the anxiety of those who are already concerned about how all of these events leave them with less money and fewer opportunities to buy a home. Guests Annie Chin, Ciro DiPalma, and Charles Giscombe offer solutions, discussing QM products, pricing, and buying and selling in today’s market.

Learn More →

The Tragedy of War and the Economic Fallout

March 9, 2022

Jeff ponders the catastrophic effects of war on the people caught in the middle of something they cannot escape from and relates how something happening halfway around the world touches us here in the US. How will it affect our day-to-day living? Guests Noah Shuffman, Anthony Alleva, and LaWanna Bradford share information on market and rate volatility, wholesale products, and an update on the Altlanta, GA, market.

Learn More →

How War in Europe Influences US Mortgage Rates

February 25, 2022

Jeff explains how the global economy is in a state of flux now that Russia has declared war on Ukraine. Inflation, already rising because of Covid, will be impacted by events in Europe as investors look for a safe haven away from the volatility inherent in wartime economics. What does this mean for interest rates and mortgages? Guests Brenda Scott, Wendy Van Wessel, and Charles Giscombe discuss loan programs and the effect of the crisis on lending.

Learn More →

Volatility on the World Stage Creates Market Uncertainty

February 16, 2022

Jeff outlines the different elements causing such dynamic shifts in the mortgage market. Upheaval in Ukraine, the specter of a recession, and inflation are all contributing factors to the daily changes in rates. How can homebuyers plan amid so much uncertainty? Jeff shares where to watch for the most reliable rate indicators. Guests Ed Peisner and Livier Becerra advise on internet safety and home buying in the current climate.

Learn More →

Strategies to Navigate a Tough Market

February 11, 2022

Jeff breaks down the inherent difficulties for anyone looking to buy or sell a home in the current financial climate. Inventory is about as low as it’s ever been, prices are high, and available properties are languishing. What can buyers and sellers do in such a tight market? Guests Justin Hardman, Nina Penny, and Connie Hernandez offer some ways to help.

Learn More →

Opportunities in the Real Estate Market

February 4, 2022

Jeff weighs the pros and cons of the current mortgage climate, from the effect of the weather on housing sales to the surprising developments in the foreclosure process. Even with low property inventory, rising rates, and inflation, is it still a good idea to try to buy a home right now? Guests Charles Giscombe and George Gonzales share their perspectives on that very question.

Learn More →

Be Here Now

January 26, 2022

Jeff encourages listeners to adopt a “Be Here Now” mindset when purchasing a new home. Buying in a hurry just to get a lower rate could result in settling for an undesirable property, but waiting for the expected changes in the economy over the next few months might make all the difference. Guests Taryll “Big Tex” Robinson and Mikke Pierson discuss smart investing and business coaching.

Learn More →

Negative vs. Positive Inflation

January 19, 2022

Jeff contrasts positive and negative inflation, and how we individually experience it shapes our opinion of it as a good or bad thing. Inflation affects almost everything in some manner, so where is it beneficial? Jeff's guests Laurie Preedge and Cindy Matthews share the latest on HELOCs and the limited housing inventory in SoCal.

Learn More →

Inflation - How Long Will It Last?

January 12, 2022

Jeff sheds some light on the many economic elements that contribute to inflation: those that are transitory and those that are more long-term. What are the aspects to be concerned about, and is there relief in sight? Guests Jason Frasier, Richard Greene, and Gentile Chhun delve into loan options, real estate, and house flipping in this evolving financial landscape.

Learn More →

What is Driving World Debt?

January 5, 2022

Jeff examines how debt affects the world economy, with examples of what we can expect in the coming months and comparisons to past financial climates. Global economic difficulties are a concern right now and always something to be mindful of, so what possible repercussions will we see here in the US? Guests Oscar Carboni, Wendy Van Wessel, and Meredith Schlosser discuss Wall Street's effect on interest rates and available loan options.

Learn More →

Real Estate - What Happened in 2021

December 22, 2021

Low interest rates and high demand creating a shortage of homes, Covid changing how and where people need to live to work, high inflation - all of these and more have impacted the mortgage market over the past year. Jeff takes a look back at 2021, with guests Connie Hernandez and Charles Giscombe forecasting what’s ahead in the industry in 2022.

Learn More →

Anxiety-Led Spending and Inflation

December 15, 2021

Jeff explores the different types of anxiety that have been brought on by the pandemic and are fueling the current spending habits of consumers. Not surprisingly, this has contributed to inflation, but how long we can expect the situation to continue? Guests Justin Simpers and Kurt Lehrmann look into cash-out refinancing and non-traditional loans.

Learn More →

What’s Ahead for the US Mortgage Market?

December 8, 2021

Jeff details the various indicators of where the market is heading leading up to and into the new year. Rumbles of uncertainty in other parts of the world, the continuing overlay of Covid, and government tapering are all coming together to make their mark on mortgage rates. Guests Jill Denton and Nina Penny report on real estate hot spots and reverse mortgages.

Learn More →

The Omicron Factor and Mortgage Rates

December 3, 2021

Jeff delves into how Omicron, the latest Covid variant, is causing volatility in the mortgage market and affecting the way consumers are choosing to spend their money. Will lower rates and overall pandemic fatigue translate into more people buying homes? Guests Reed Blake and Phil Berson weigh in on business lines of credit and issues with housing inventory in the LA area.

Learn More →

Wage Inflation vs. Supply-Side Inflation

November 17, 2021

Jeff examines the differences between wage and supply-side inflation and the unique ways they affect the economy. Can inflation actually be a beneficial thing? Guests Christian Ramos, Dr. Jeannie Bertoli, and Josh Thompson share their views on conventional interest rates, societal volatility, and catalysts that spur economic growth.

Learn More →

Determining Loans and Rates

November 10, 2021

Jeff delineates the qualifications brokers and lenders consider when ascertaining the right home loan for each borrower. To prepare consumers for their loan search, he advises what trends to track, the predictable things to watch for, and warns that lenders adjust their risk level in response to unpredictable local and global events. Guests Darren Woodworth and Eric Morgenson shed light on the seller’s market and rental properties.

Learn More →

China's Ripple Effect on Mortgages

November 3, 2021

Jeff outlines the direct correlation of global events to the mortgage rate in the US. The changes in China’s economy from an agrarian to an urban/middle-class society have spurred unprecedented growth and higher consumption rates of American raw materials, affecting how we spend money here. Guests Connie Hernandez, Robert Perez, and Noah Shuffman present the latest on loans, investment properties, and technology.

Learn More →

Can Pricing-In Help You Secure a Good Rate?

October 31, 2021

Jeff explains pricing-in - how lenders use the information shared by the government on the proposed direction of interest rates to determine the setting of mortgage rates. With more homes on the market, now might be a good time for borrowers to take advantage of pricing-in to lock in a favorable loan rate. Sharon Moten, Charles Giscombe, and George Gonzales offer their insights on making it happen.

Learn More →

Anxiety in the Marketplace Means Higher Rates

October 20, 2021

Jeff focuses on the underlying causes that drive whether rates will go up or down. Global events like the pandemic have a domino effect on everything else, creating uneasiness in financial markets around the world. How will consumers be able to afford a home loan in this climate? He and his guests Michelle Wilde and Clint Brown discuss loan assistance programs and the future of solar energy.

Learn More →

How Much Affordability Does Your Dollar Bring Today?

October 13, 2021

Jeff compares politics and real estate, noting that social media and the internet have turned local events into national concerns This influences the financial landscape, determining the amount of money people have to spend and how they are willing to spend it. Richard Greene, Wendy Van Wessel, and Sarah Liang share ideas to help hang onto more of that hard-earned money.

Learn More →

As Tapering Nears, Mortgage Companies Must Adjust

October 13, 2021

Jeff explores the probable measures loan companies are looking to adopt as government tapering nears. Some companies will not survive, some will consolidate, and some will privatize. Can loan seekers benefit from this reshuffling in the mortgage market? Guests Zack Harmon, Tyler Sinks, and Tracy Madden look into alternative energy options, multi-family real estate, and the desirability of the San Diego market.

Learn More →

What Does Raising the Debt Ceiling Mean for Mortgages?

September 29, 2021

Jeff breaks down the different aspects of how government debt directly affects the setting of interest rates for mortgages and why buyers should pay close attention to the decisions Congress makes concerning the debt ceiling. Are there more questions than answers? Guests Gino Payne, Maria Schroeder, and Jessica Hearns talk about entrepreneurs, small business owners, and what’s happening in the Las Vegas market.

Learn More →

Tapering, Unemployment, and Weather - Oh My!

September 22, 2021

Jeff examines the numerous factors currently facing prospective homebuyers. The questions of tapering vs. inflation and employment vs. unemployment will influence the setting of interest rates, and recent extreme weather occurrences serve as a reminder that Mother Nature must always be part of the equation. Guests Jennifer Conrad, Luke Manke, and Tim Wise share insights on loans and programs.

Learn More →

What Causes Inflation?

September 15, 2021

Jeff breaks down the different causes of inflation and the effect it has on the economy. He is “on location” in Las Vegas, finding that businesses are booming and entrepreneurs are thriving, even in an inflationary market. His guests Oscar Carboni, Joann Munz, and Charles Giscombe bring some of their entrepreneurial insight into the world of cryptocurrency, property management, and non-QM loans.

Learn More →

Natural Disasters Can Put the Brakes on Your Loan

September 1, 2021

Jeff checks in with his sound engineer Darrell regarding the recent fires up in Lake Tahoe to get an idea of how residents in that area are being impacted, shining a light on an important aspect of loan consideration – natural disasters. Guests Ronnie Montana, Celia Rios, and Brendan McBreen discuss high market prices, the loan qualification process, and how best to stage a home.

Learn More →

Are House Hunters Taking a Covid Time Out?

August 25, 2021

Jeff ponders the way people have changed their home searching behavior due to Covid concerns. Health worries and the stress of children going back to in-person classes are some of the reasons fewer people are actively looking for homes. Is this creating an opening for buyers? Jeff continues his spotlight on entrepreneurs with guests Joe McKone and Kurt Lehrmann.

Learn More →

Is Now a Good Time to Buy a Home or Start a Business?

August 20, 2021

Jeff invites entrepreneurial experts Tim O'Keefe and Jaime Kinser to share strategies to help maximize marketing opportunities for new and existing businesses. With tapering on the horizon and margins shrinking, higher interest rates are in the not-too-distant future. Guests Bambi Olesky and Nina Penny help decipher what this means for prospective home buyers.

Learn More →

Real Estate - Constantly Evolving and Changing

August 13, 2021

Jeff shares statistics for the housing shortage and how individual cities have such a big effect on determining the current high prices. Additionally, he introduces the latest strategies mortgage companies are using to try and reach more of the real estate market. Guests Brenda Scott and Maria Schroeder explore programs available to help buyers with lower income and credit scores.

Learn More →

Rate-and-Term Refi or Cash-Out Refi – How Do You Choose?

August 4, 2021

Jeff explains the differences between Rate-and-Term vs. Cash-Out Refis and Owner-Occupied vs. Non-Owner-Occupied loans. He also discusses high-risk loans, who invests in them, and why. Charles Giscombe, George Gonzales, and Patrick Washington bring some clarity to the process of finding the most advantageous loan for every client.

Learn More →

Why Are Appraisal Protocols So Inconsistent?

July 30, 2021

Jeff sheds light on the manner in which Covid has driven the backlog of home appraisals and created the perplexing duality of low-interest rates/high housing prices. Gentille Chhun, Mitch McClellan, and Jennifer Conrad give their input on how to navigate a multiple-offer market, what’s happening in talk radio, and the importance of loan officers.

Learn More →

The Ripple Effects of Covid and Weather on Real Estate

July 23, 2021

Jeff investigates how Covid, weather-related incidents, and natural disasters are impacting both the loan application process and the national real estate market in general. LaWanna Bradford, Eddie Rael, and Darren Woodworth provide perspectives on how different parts of the country are dealing with these issues.

Learn More →

An Interesting Summer in the Housing Market

July 21, 2021

In this episode, Jeff explores the factors involved in creating this most unusual housing market. What programs are advantageous today compared to those anticipated in the future? How do rates affect the decision in choosing a QM or non-QM loan? Jeff’s guests Maria Schroeder, Brenda Scott, and Charles Giscombe help to shed some light on how this summer’s unique circumstances are being addressed.

Learn More →

Big Surprises and Breakthroughs in the Bond Market

July 14, 2021

Jeff discusses the bond market's unexpected turn, which was the polar opposite of expectations. How does that correlate to the availability of inventory? The ability to repay rule is changing, and the QM loans qualifications are evolving with it. He gains some insight on the home affordability in different markets from guests Jill Denton, Connie Hernandez, and Laura Preege.

Learn More →

Is Real Estate a Contact Sport?

June 25, 2021

Jeff makes sense of the confusing information surrounding the loan-making process and how to best navigate through it. Guests Noah Schuffman and Bill Orr discuss securitization, niche product offerings, and the drawbacks of a seller's market.

Learn More →

There’s More to a Good Rate Than Just the Lowest Number

June 18, 2021

Jeff details the elements that go into determining how you qualify for the lowest rate - what makes up the rates, how credit scores are used, and the external factors happening in the economy. Charles Giscombe, Parzad Razi, and Rebekah Fitzgerald discuss getting into a new home now post-COVID, low FICO score programs coupled with manual underwriting, and the advantages of being in the real estate business.

Learn More →

Should You Refi?

June 8, 2021

Jeff explains how interest rates are set, noting the 10-year bond's performance as a crucial component, and why he believes we're in an artificial market because of the way the government purchases debt. His guests, Chris Groves and George Gonzales, discuss new purchases vs. refinancing, appraisal concerns, and which programs are most advantageous to their clients.

Learn More →

Unusual Factors Affecting Homeownership

June 3, 2021

Jeff discusses the problem of the surplus of available jobs relative to negative population growth and how that translates into difficulties in creating homeownership. He and his guests Alma Carrera and Tomas Trujillo explore bank statement loans for those who are self-employed, non-QM programs, and down payment assistance.

Learn More →

Is Speed an Advantage in Getting the Best Possible Loan?

May 27, 2021

Jeff weighs the pros and cons of trying to get a home loan quickly vs. taking time to get help with researching one that is tailored to your individual needs, Prime/Alt Prime Loans, and wading through the sheer number of other potential buyers in this low-inventory housing market with guests Bill Orr, April Lopez, and Richard Giscombe.

Learn More →

Don’t Settle for a Cookie-Cutter Loan

May 11, 2021

Jeff stresses the importance of finding the right loan officer for your situation and being honest with them during the application process, introduces some of the latest loan programs and financial products, and helps define an “invisible loan” with guests Celia Rios, Taryll Robinson, Reed Blake, and Richard Greene.

Learn More →

Is a Non-Traditional (Non-QM) Loan Right for You?

May 4, 2021

Jeff explains the different qualifications needed to obtain a loan, what variables will affect the types of loans prospective homebuyers are eligible to receive, and some of the “shortcuts” to avoid with guests Ryan Bagan, Chris Calderon, and Kim Soash.

Learn More →

Home Price Appreciation – Is it Sustainable?

April 27, 2021

Jeff discusses whether or not we are experiencing another “Housing Bubble”, entrepreneurs during COVID, integrity in the real estate business, and demystifying the home buying process with guests Ed Peisner, Eddie Rael, and Charles Giscombe.

Learn More →

What Qualities Appeal Most to Lenders?

April 22, 2021

Jeff gives insight into how lenders decide what loans are approved, what changes are on the horizon for qualified loans, and his guests Dean Garrett, Kim Tran, and Wendy Van Wessel discuss programs that are available to prospective homebuyers.

Learn More →

What are the Impediments to Building Affordable Housing?

April 13, 2021

In this episode, Jeff offers solutions to help make it easier to build more affordable housing and talks about what’s new in reverse mortgages with guests Adam Potafiy and Nina Penny.

Learn More →

How Can We Help More People Become Homeowners?

April 12, 2021

Jeff explores the scarcity of homes in the marketplace, new loan options, and the issues surrounding making more low-income housing available in communities across the Southland with guests Honey Manderville, Noah Schuffman, and Livier Becerra.

Learn More →

The "Why" Behind Increasing Mortgage Rates

March 10, 2021

Is now a good time to refinance? Jeff breaks down the "why" behind the recent rise in mortgage rates and how these unique times and the mixed bag of investment options in the marketplace will affect your decision, with guests Dr. Jeannie Bertoli, Patrick Washington, and April Lopez.

Learn More →