Marry the House, But Only Date the Interest Rate

Between high home prices and fewer properties on the market, inflation, and Fed rates, prospective homebuyers are faced with a dilemma as to what they can afford and often want to wait until rates show some indication of declining. Is that the best option when they find the right home to purchase? The advice from mortgage and real estate professionals is clear: “Marry the house, but only date the interest rate.” What does this mean in practical terms? It suggests focusing on finding the right property rather than waiting for ideal rates, with the expectation of refinancing when rates eventually decrease. But how long will buyers need to wait for more favorable conditions? With the complexity of today’s mortgage and real estate landscape, the answer is difficult to gauge.

The Federal Reserve’s recent decision to maintain current rates has significant implications for the mortgage market. Persistent inflation concerns are at the forefront, with the possibility of another rate hike before year-end, contrary to earlier expectations of multiple rate cuts. How does this uncertainty impact potential homebuyers and refinancers? The relationship between Fed rates and mortgage rates is a complex one, and while Fed rates don’t directly set mortgage rates, they do influence them. This connection means that the decisions have far-reaching implications for the housing market and the broader economy. The Fed aims for a 2% inflation rate, balancing economic stability with gradual growth, allowing for steady wage increases and price adjustments. The higher interest rates are set to combat inflation, which has decreased from a peak of 9-9.5% to around 3-3.5%, but stubbornly remains above the 2% goal. How would a prolonged climate of higher rates affect the housing market? This week’s guests include:

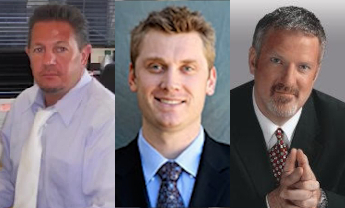

– Ciro De Palma (Change Wholesale) outlines no-income verification loans based on FICO scores and reserves, requiring a 25% down payment.

– Luke Manke (Malibu Funding) notes that it’s primarily a purchase market now with few refinances, with cash buyers making it difficult for financed offers to compete in some areas.

– Bill Orr (Malibu Funding) highlights growing challenges in obtaining home insurance in California as many major insurers leave the market.